Introduction

Finding the perfect home is a monumental task that requires careful consideration and planning. With so many options available, it's easy to feel overwhelmed by the decision-making process. However, by using a structured approach, such as a home comparison checklist, you can simplify the process and ensure that you make the right choice. In this article, we'll explore the importance of choosing the right home and how you can use a home comparison checklist to streamline your search.

Understanding Your Needs

Finding the perfect home involves more than just browsing through listings and visiting properties. It requires a deep understanding of your own needs, preferences, and priorities.

A. Identifying Your Priorities in a Home

Before you start your home search, take some time to reflect on what matters most to you in a

living space. Consider factors such as location, size, amenities,

and style. Are you looking

for a quiet suburban neighborhood or the hustle and bustle of city life? Do you need a

certain number of bedrooms and bathrooms to accommodate your family or lifestyle? Are

features like a backyard, a modern kitchen, or a home office important to you?

Make a list of your top priorities and rank them in order of importance. This will serve as

a guiding framework as you evaluate different properties and make decisions along the way.

B. Assessing Your Lifestyle and Preferences

Your lifestyle plays a significant role in determining the type of home that will suit you

best. Think about your daily routines, hobbies, and activities. Do you enjoy entertaining

guests and need ample space for social gatherings? Are you an outdoor enthusiast who desires

proximity to parks or nature trails? Are you planning to work from home and require a

dedicated office space?

Understanding how you live and what you value in your day-to-day life will help you narrow

down your search and focus on homes that align with your lifestyle preferences.

C. Setting a Budget

One of the most critical aspects of the home-buying

process

is setting a realistic budget.

Take an honest look at your finances and determine how much you can comfortably afford to

spend on a home. Consider factors such as your income, existing debt, monthly expenses, and

savings for a down payment.

It's essential to not only consider the upfront costs of purchasing a home but also factor

in ongoing expenses such as mortgage payments, property taxes, insurance, and maintenance.

Use online affordability calculators or consult with a financial advisor to determine a

budget that works for you.

By identifying your priorities, assessing your lifestyle, and setting a budget, you'll be

better equipped to navigate the home-buying process with confidence and clarity. These

foundational steps will guide you in finding a home that not only meets your practical needs

but also enhances your quality of life.

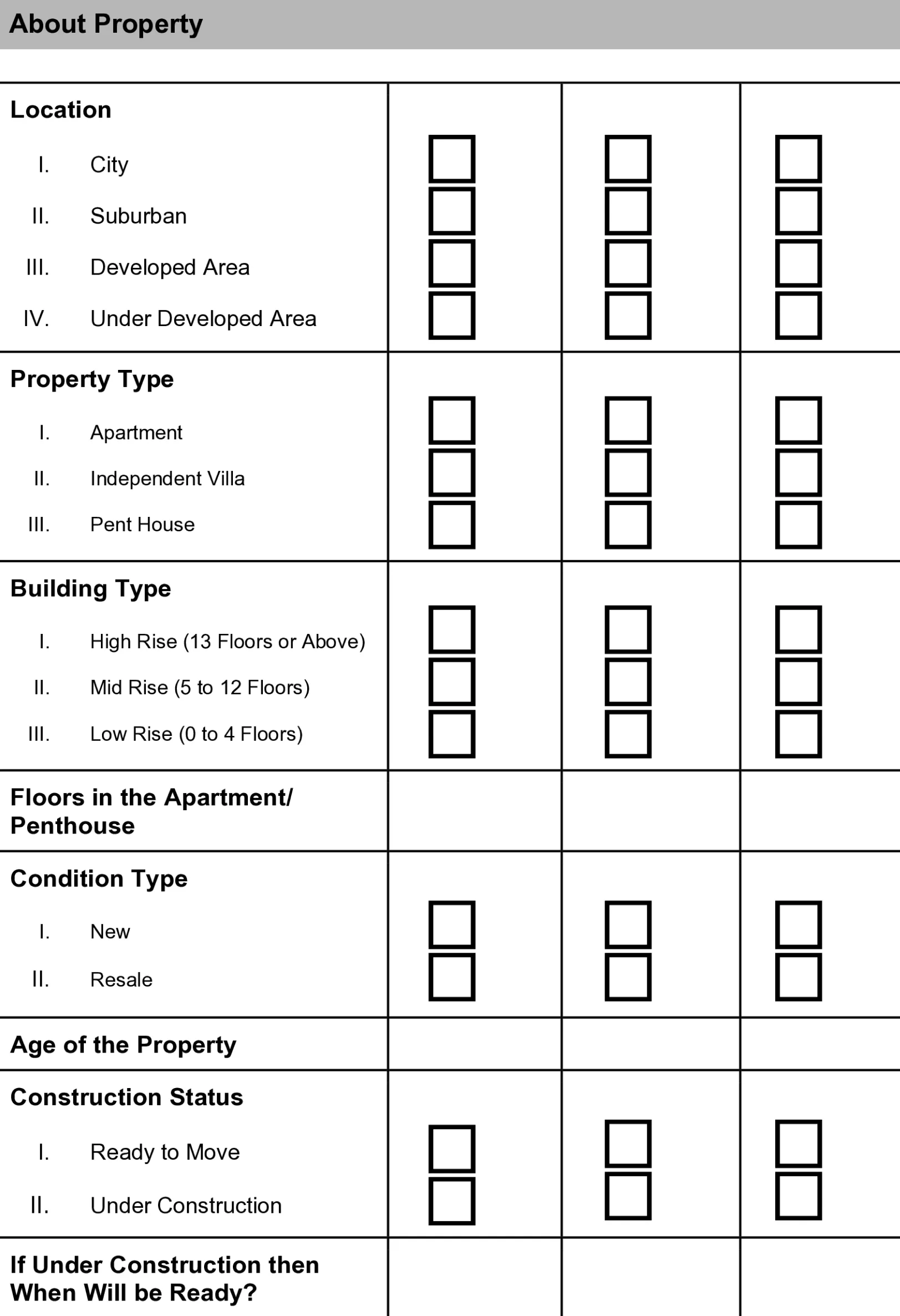

Home Comparison Checklist

How to Use the Checklist Effectively

Once you've created your home comparison checklist, the next step is to utilize it effectively to evaluate different properties and make informed decisions.

A. How to Compare Different Homes Based on Your Checklist

i. Gather Information

Start by collecting detailed information about each property you're considering. This may include listing descriptions, photos, virtual tours, and any additional documents provided by the seller or real estate agent

ii. Fill Out the Checklist

Transfer the relevant information from your research into the corresponding sections of your home comparison checklist. Be sure to include all the criteria and categories that are important to you, such as location, size, amenities, condition, and price.

iii. Rate Each Criterion

Assign a rating or score to each criterion based on how well each property meets your preferences and needs. You can use a simple scale (e.g., 1 to 5) or a more detailed scoring system to quantify your assessment

iv. Compare Side by Side

Review the completed checklists for each home side by side. Pay attention to any patterns or trends that emerge, such as certain properties consistently scoring higher in certain categories.

v. Identify Trade-offs

Recognize that no home is likely to tick off every box on your checklist perfectly. Consider which criteria are non-negotiable for you and where you're willing to compromise.

B. Analyzing the Pros and Cons of Each Option

i. List Pros and Cons

Make a list of the advantages and disadvantages of each property based on your checklist evaluation. Consider tangible factors (e.g., location, size, amenities) and intangible factors (e.g., neighbourhood vibe, future potential).

ii. Weigh the Importance

Evaluate the significance of each pro and con relative to your overall priorities and preferences. Some factors may carry more weight than others depending on your circumstances.

iii. Seek Outside Input

Consider seeking input from trusted friends, family members, or real estate professionals. They may offer valuable insights or perspectives that you hadn't considered.

iv. Consider Long-Term Implications

Think about how each option aligns with your long-term goals and aspirations. A property that may seem appealing now may not be the best fit for your plans.

Making the Final Decision

A. Considering Intangible Factors

- Trust your gut feeling and consider how each home resonates with you emotionally.

- Think about your plans and whether each property aligns with your long-term goals.

B. Seeking Advice from Professionals or Trusted Individuals

- Hire a home inspector to uncover any hidden issues.

- Seek advice from trusted friends or family members who have experience with homeownership.

C. Finalizing Your Choice and Moving Forward

- Review your checklist and notes to ensure you've considered all factors.

- Take time to reflect on your options and make a decision with confidence.

- Once decided, take action promptly to secure your chosen property.

Conclusion

I encourage you to utilize the home comparison checklist outlined in this guide as you embark

on your home-buying journey. By following the steps outlined and using the checklist

effectively, you can streamline your search process and increase your chances of finding the

perfect home that meets all your criteria.

Remember that buying a home is a significant milestone, and it's essential to take your

time, do your research, and trust your instincts. Keep in mind that no home is perfect, but

with careful consideration and the guidance of your checklist, you can find a home that

meets the majority of your needs and feels right for you.

I wish you the best of luck in your home-buying endeavours. May you find a place to call

your own, where you can create lasting memories and enjoy the comforts of home for years to

come