Property tax is a significant responsibility for property owners, and if you're a resident

of Vapi, it's crucial to stay on top of your Vapi Nagarpalika property tax. Whether you're a

first-time taxpayer or need a refresher on the payment methods, this guide will walk you

through paying your Vapi Nagarpalika property tax online and offline.

In this blog, we'll explore everything from checking your property tax dues to the actual

steps involved in making your payments hassle-free.

What is Vapi Nagarpalika Property Tax?

Vapi Nagarpalika property tax is a local tax levied by the Vapi Municipal Council (Nagarpalika) on property owners. It is used to maintain and improve local infrastructure and public services, such as roads, water supply, and sanitation. As a property owner in Vapi, you must pay this tax annually. Failing to pay on time can result in penalties, so it's crucial to understand how much you owe and how to make the payments efficiently.

How to Pay Vapi Nagarpalika Property Tax Online

Paying your Vapi Nagarpalika property tax online is the easiest and quickest way to complete

your tax obligation. Here’s a step-by-step guide to ensure you can make your payment

smoothly:

Step-by-Step Guide to Online Payment Process

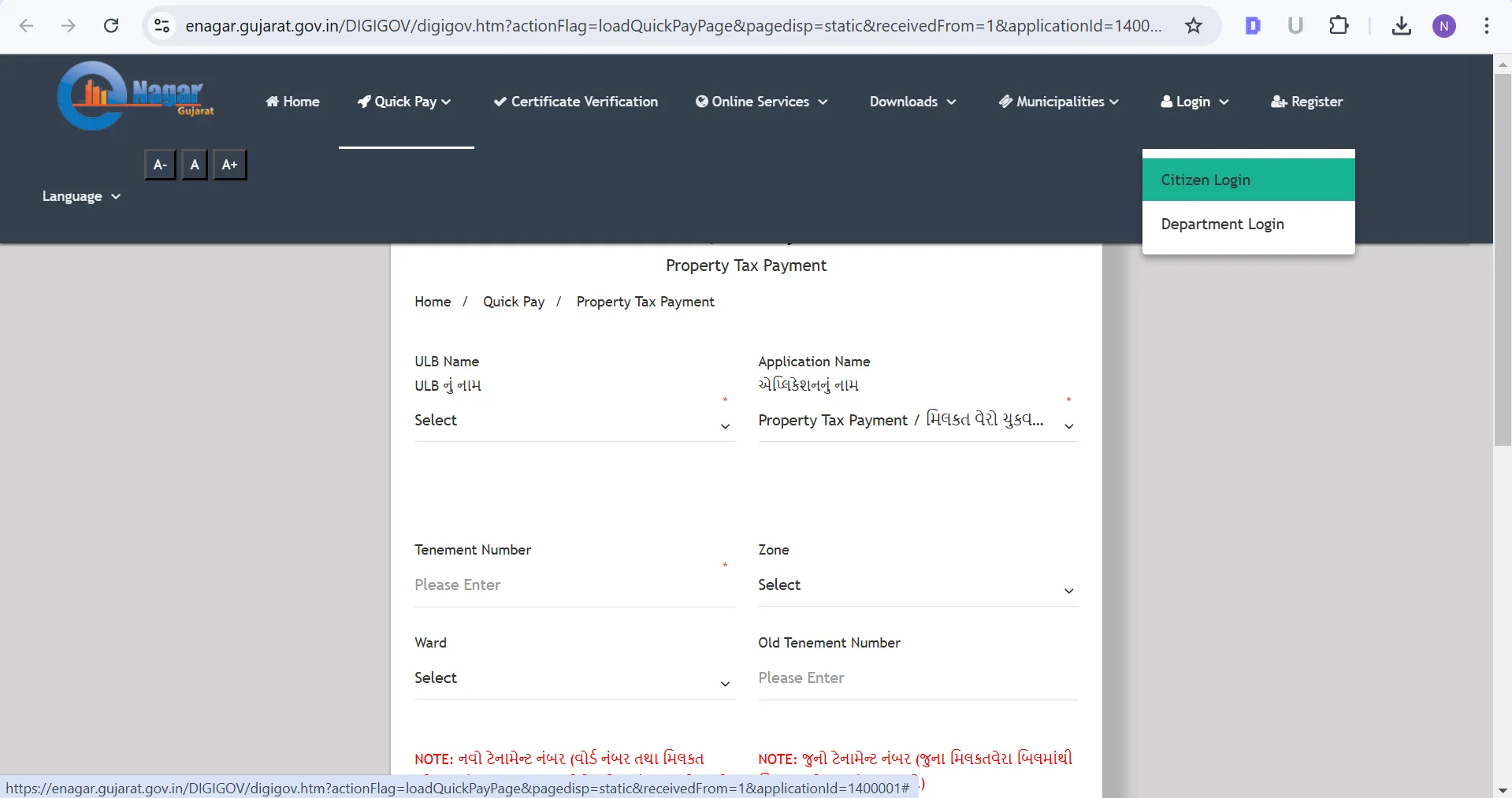

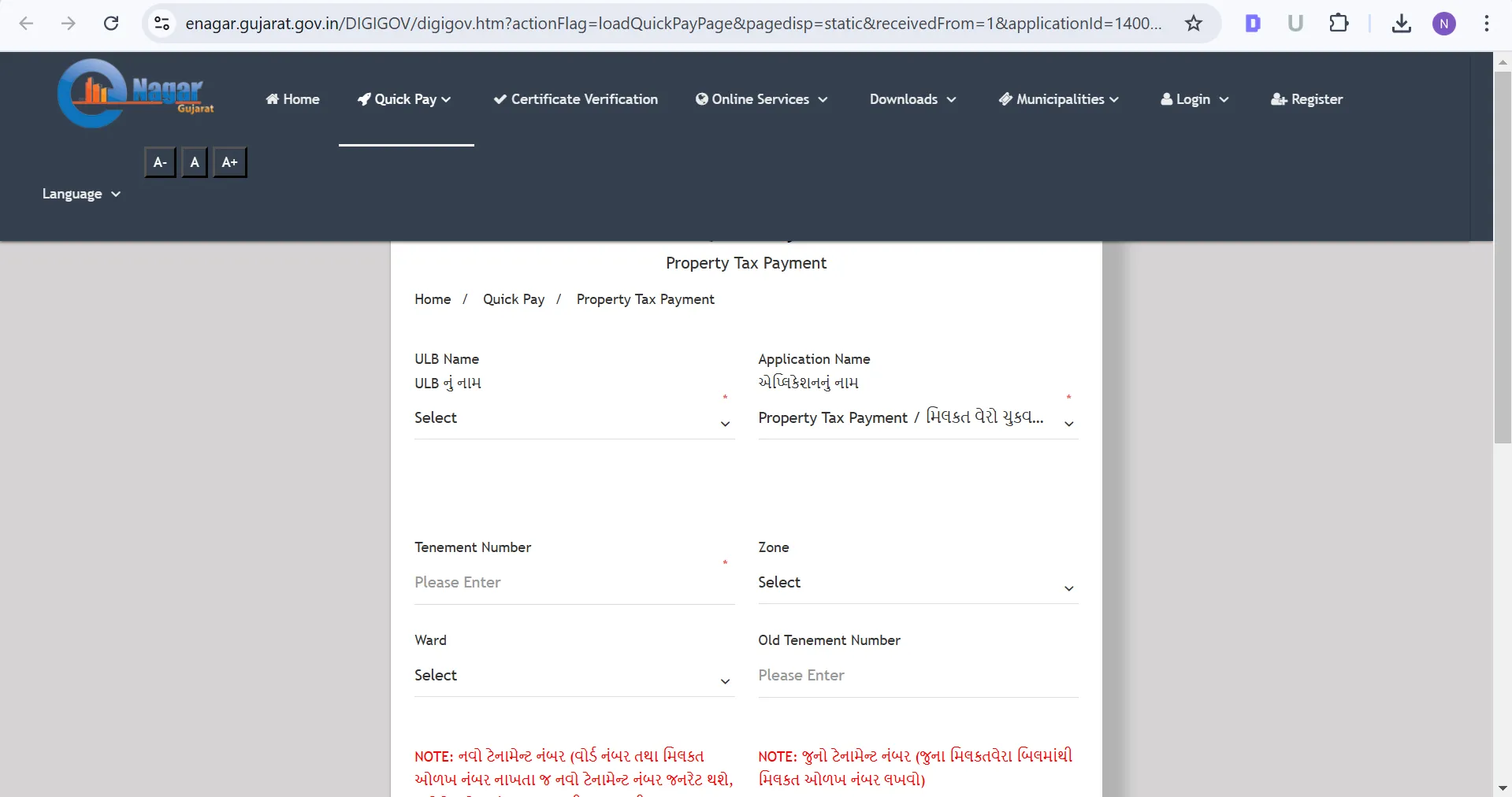

1. Visit the Official Property Tax Portal

Go to the official website of Vapi Nagarpalika

2. Click on Pay Property Tax

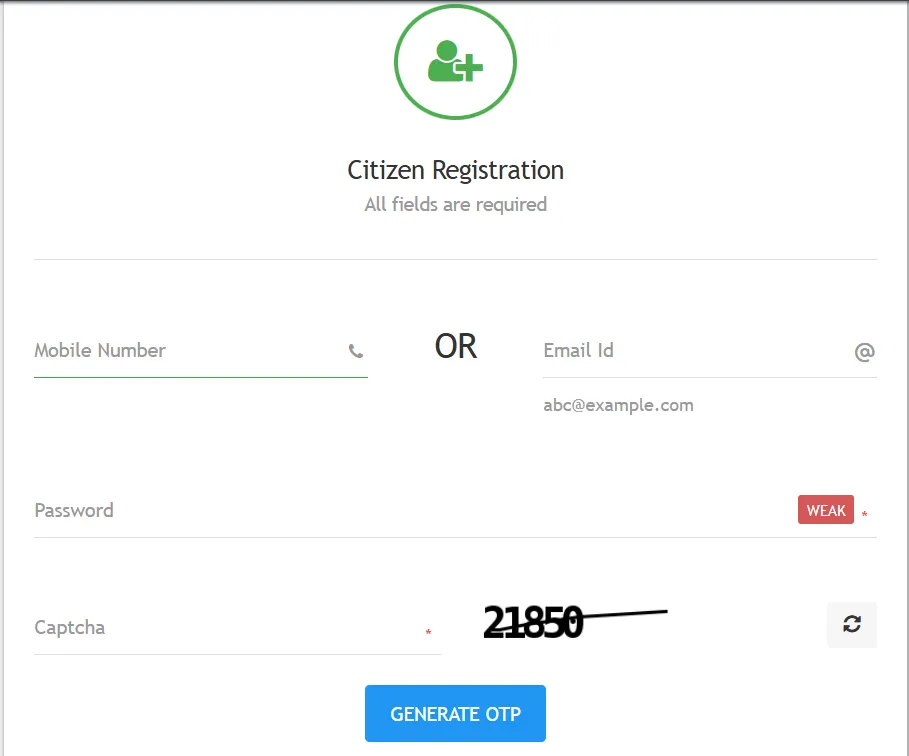

3. Login or Register

If you have already an account then click on login >> citizen login and enter your login details.

If you don’t have an account then register with an email ID or mobile number.

4. Fill out the Property Tax Payment Form

5. Select Payment Method

The portal will offer several payment options, including:

Net Banking

Credit/Debit Cards

UPI (Unified Payments Interface)

6. Make the Payment

After selecting your payment method, follow the prompts to complete the transaction.

7. Download the Payment Receipt

Once your payment is processed, the portal will generate a digital receipt. Make sure to save or print this receipt for your records.

List of Accepted Payment Methods

The Vapi Nagarpalika property tax portal typically accepts the following payment methods:

1. Net Banking

Direct payment from your bank account using your bank’s net banking service.

2. Debit/Credit Cards

Use your Visa, Mastercard, or other major credit or debit cards to pay instantly.

3. UPI (Unified Payments Interface)

Payments can also be made using UPI apps such as Google Pay, PhonePe, or BHIM for fast,

mobile-based payments.

Tips for a Successful Online Payment

1. Ensure a Strong Internet Connection

Make sure you have a stable internet connection to avoid payment interruptions.

2. Use Secure Payment Gateways

Always check for "https" in the URL before entering your payment details to ensure a secure

connection.

3. Double-Check Payment Details

Ensure that all your property details and the payment amount are accurate before proceeding.

4. Save Your Receipt

After making the payment, download the receipt immediately. This serves as proof of payment

and can be used if any discrepancies arise later.

5. Avoid Peak Hours

If possible, try to make your payment during non-peak hours to avoid server overloads, which

can sometimes cause delays.

How to Pay Vapi Nagarpalika Property Tax Offline

To pay your Vapi Nagarpalika property tax offline, visit the Nagarpalika office with the

necessary documents. Once there, you can collect the required form from the designated

counter, fill it out, and submit it along with your payment. Ensure you receive an official

receipt after completing the payment. The contact details for the Vapi Nagarpalika office

are provided below for your reference.

Address

Vapi Municipality Desaiwad Road, Behind Police Station, Vapi - 396191, Gujarat, India.

E-mail ID

vapimunicipality@gmail.com

Phone

+91 260 246 2803, +91 260 246 3378

Conclusion

Paying your Vapi Nagarpalika property tax on time is essential for avoiding penalties and

maintaining your civic responsibilities. Whether you choose to pay online or offline, both

methods are relatively simple and convenient. The online process allows for quick and easy

payments, while the offline method gives you the benefit of personal assistance.

Choose the method that works best for you, and ensure you keep all records and receipts for

future reference. Regular tax payments not only help you avoid late fees but also contribute

to the development and improvement of your community's infrastructure.